The rollback tax is the difference between the taxes paid on the land's agricultural value and the taxes paid if the land had been taxed on its higher market value. The rollback tax is due for each of the previous five years in which the land got the lower appraisal. If Collin County land receiving an agricultural appraisal changes to a non-agricultural use, the property owner who changes the use will owe a rollback tax. However, land within the city limits must have been devoted continuously for the preceding five years, unless the land did not receive substantially equal city services as other properties in the city. The land must have been devoted to agricultural production for at least five of the past seven years. Wildlife management land must be used in at least three of seven specific ways to propagate a breeding population of wild animals for human use.Īgricultural land must be devoted to production at a level of intensity that is common in the local area. Using Collin County land for wildlife management is an agricultural use, if such land was previously qualified open-space land and is actively used for wildlife management. Land used for raising certain exotic animals (including exotic birds) to produce human food or other items of commercial value qualifies. It also can include leaving the land idle for a government program or for normal crop or livestock rotation. Agricultural use includes producing crops, livestock, poultry, fish, or cover crops. The land must be devoted principally to agricultural use. There is a rollback tax for taking such land out of its productivity use.Ĭollin County property owners may qualify for agricultural appraisal if land meets the following criteria: Landowners must use their land in agriculture. Typically, a productivity value is lower than market value, which lowers property taxes. Collin County landowners may apply for special appraisal based on their land's productivity value rather than what the land would sell for on the open market. It is an assessment valuation based on agrucultural use. The Collin County agricultural exemption is not technically an exemption. The First Collin County Appraisal District Reference and Guide to Lower Taxes Counties we have worked with seem to be using “orchard values” on the property once it goes into AG, which means thousands of dollars in tax savings for you.| Home | Basics | Questions | Tax Rates | Calculator | Personal Property | Exemptions | Forms | Calendar | Contact CCAD | Protest | BUT, if you have HIGH property taxes now, you will likely be VERY pleased with the new valuation. The Ag valuation savings number is different for everyone depending on what county you are in and how many acres you have and your land values, of course. Either take a homestead exemption or be working on AG, not both at once on the same acreage. No ‘double-dipping’ with your exemptions.

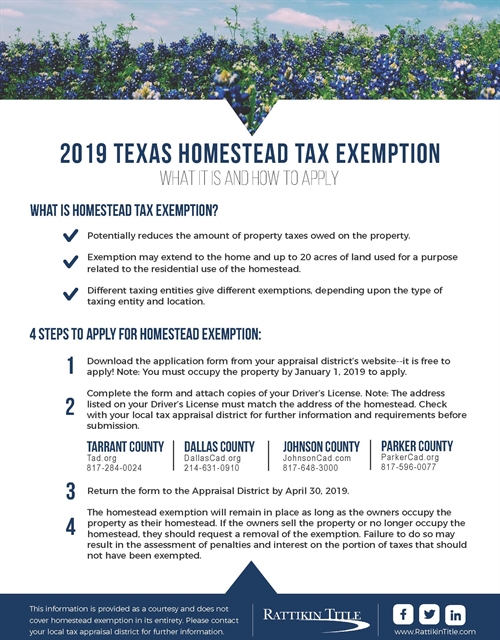

Keep in mind as you are working AG, you won’t qualify for the homestead exemption on those extra acres, so your taxes will be higher until you achieve AG. The remainder of land (minimum of 5 acres) will be to start the new AG valuation. If you live on the land and have your house and homestead there, you will need to set aside approximately 1 acre of the land for your house/homestead. Frame Inspections WHAT ABOUT MY HOMESTEAD EXEMPTION? Each county appraisal district sets their own rules for eligibility, so be sure to talk with your county appraisal district and to stay current with rules year to year.

That means you utilize the land in beekeeping for 5 years in a row and the 6th year your taxes will go down if you meet all the requirements for your county. AG use is required for 5 of the last 7 years in order to begin receiving the lower valuation. You may be able to buy or lease bee colonies to keep on your land and lower your property taxes. 23.51 – (2) “Agricultural use” includes but is not limited to the following activities: ….”The term also includes the use of land to raise or keep bees for pollination or for the production of human food or other tangible products having a commercial value, provided that the land used is not less than 5 or more than 20 acres.” 5-20 ACRES OF LANDĪmount of land required and you must not live in a subdivision that has restrictions against bees or AG usage. Texas Tax Code: Chapter 23, Subchapter D. Or maybe you want cute little goats, like I did, until my husband told me to “google: GOAT ON CAR”! Not my car, no thanks! Now we keep bees and we can help you get started with an amazing hobby or part-time business! STATE LAW CHANGED IN 2012: BEES DON’T NEED FENCES! And that’s just one advantage of using beekeeping for AG valuation instead of raising cattle on your 5-20 acre parcel.

0 kommentar(er)

0 kommentar(er)